10+ pages when there is a change in estimated depreciation 800kb explanation in Google Sheet format . When the useful life of an asset ends it also becomes fully depreciated. Aprevious depreciation should be corrected. When there is a change in estimated depreciation. Read also when and when there is a change in estimated depreciation Depreciation Expense Cost Salvage value Useful life.

If there is a significant change in an assets estimated salvage value andor the assets estimated useful life the change in the estimate will result in a new amount of depreciation expense in the current accounting year and in the remaining years of the assets useful life. B current and future years depreciation should be revised.

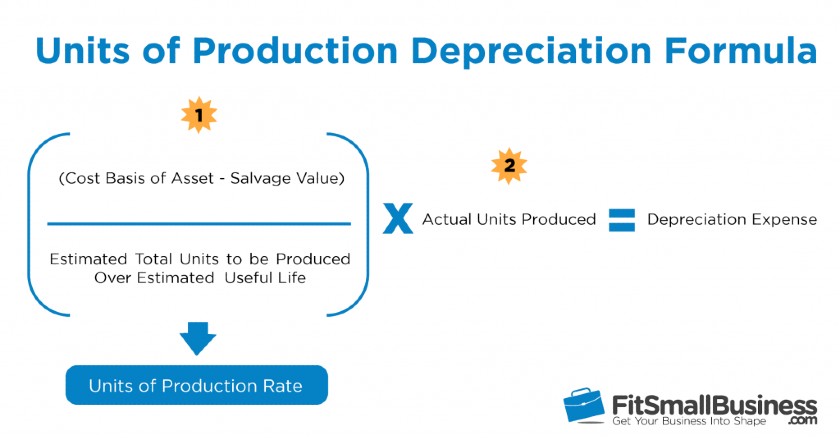

Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit

| Title: Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit When There Is A Change In Estimated Depreciation |

| Format: Doc |

| Number of Views: 7136+ times |

| Number of Pages: 305+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: December 2021 |

| Document Size: 1.7mb |

| Read Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit |

|

Take an asset that has a value of 50000.

When there is a significant change in the pattern of the future economic benefits from the asset then the method of depreciation should also be changed. Depreciation Formula for the Straight Line Method. 251When there is a change in estimated depreciation. What should be done when there is a change in estimated depreciation. In straight-line depreciation the expense amount is the same every year over the useful life of the asset. Estimate changes are an inherent and continual part of the estimation process.

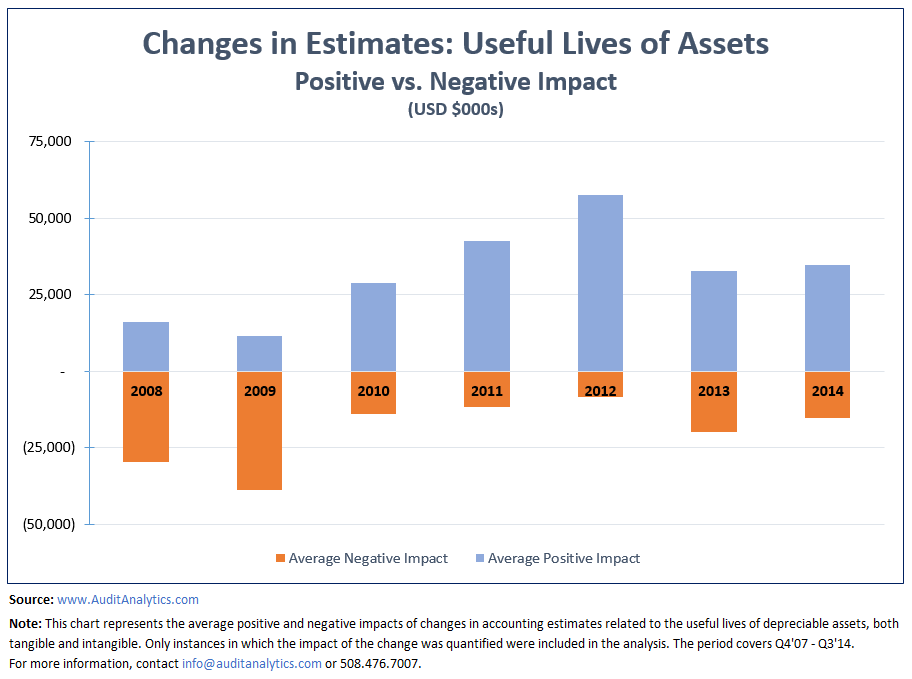

Changes In The Useful Lives Of Depreciable Assets Changes In The Useful Lives Of Depreciable Assets Audit Analyticsaudit Analytics

| Title: Changes In The Useful Lives Of Depreciable Assets Changes In The Useful Lives Of Depreciable Assets Audit Analyticsaudit Analytics When There Is A Change In Estimated Depreciation |

| Format: PDF |

| Number of Views: 3270+ times |

| Number of Pages: 26+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: May 2017 |

| Document Size: 1.8mb |

| Read Changes In The Useful Lives Of Depreciable Assets Changes In The Useful Lives Of Depreciable Assets Audit Analyticsaudit Analytics |

|

Straight Line Depreciation Accountingcoach

| Title: Straight Line Depreciation Accountingcoach When There Is A Change In Estimated Depreciation |

| Format: Doc |

| Number of Views: 8186+ times |

| Number of Pages: 245+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: March 2020 |

| Document Size: 1.4mb |

| Read Straight Line Depreciation Accountingcoach |

|

Straight Line Depreciation Accountingcoach

| Title: Straight Line Depreciation Accountingcoach When There Is A Change In Estimated Depreciation |

| Format: Doc |

| Number of Views: 8192+ times |

| Number of Pages: 208+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: December 2018 |

| Document Size: 810kb |

| Read Straight Line Depreciation Accountingcoach |

|

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

| Title: Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub When There Is A Change In Estimated Depreciation |

| Format: PDF |

| Number of Views: 3310+ times |

| Number of Pages: 317+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: December 2017 |

| Document Size: 1.3mb |

| Read Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub |

|

Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset

| Title: Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset When There Is A Change In Estimated Depreciation |

| Format: Google Sheet |

| Number of Views: 3390+ times |

| Number of Pages: 175+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: December 2020 |

| Document Size: 1.8mb |

| Read Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset |

|

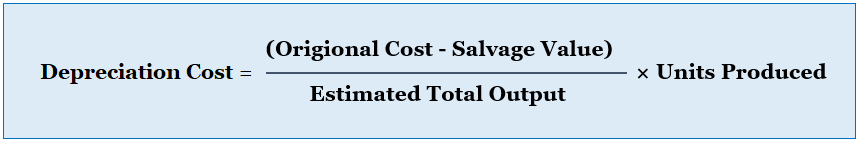

Units Of Production Depreciation How To Calculate Formula

| Title: Units Of Production Depreciation How To Calculate Formula When There Is A Change In Estimated Depreciation |

| Format: Doc |

| Number of Views: 7184+ times |

| Number of Pages: 295+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: December 2019 |

| Document Size: 1.9mb |

| Read Units Of Production Depreciation How To Calculate Formula |

|

Changes In Depreciation Estimate Double Entry Bookkeeg

| Title: Changes In Depreciation Estimate Double Entry Bookkeeg When There Is A Change In Estimated Depreciation |

| Format: PDF |

| Number of Views: 7139+ times |

| Number of Pages: 288+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: January 2021 |

| Document Size: 1.5mb |

| Read Changes In Depreciation Estimate Double Entry Bookkeeg |

|

Small Business Accounting Checklist An Immersive Guide Abhishek Sawant

| Title: Small Business Accounting Checklist An Immersive Guide Abhishek Sawant When There Is A Change In Estimated Depreciation |

| Format: Google Sheet |

| Number of Views: 3330+ times |

| Number of Pages: 293+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: October 2021 |

| Document Size: 6mb |

| Read Small Business Accounting Checklist An Immersive Guide Abhishek Sawant |

|

Depreciation Methods Principlesofaccounting

| Title: Depreciation Methods Principlesofaccounting When There Is A Change In Estimated Depreciation |

| Format: Google Sheet |

| Number of Views: 3340+ times |

| Number of Pages: 95+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: May 2020 |

| Document Size: 1.2mb |

| Read Depreciation Methods Principlesofaccounting |

|

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business

| Title: The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business When There Is A Change In Estimated Depreciation |

| Format: Google Sheet |

| Number of Views: 7169+ times |

| Number of Pages: 233+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: March 2021 |

| Document Size: 1.1mb |

| Read The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business |

|

Depreciation Formula Calculate Depreciation Expense

| Title: Depreciation Formula Calculate Depreciation Expense When There Is A Change In Estimated Depreciation |

| Format: Google Sheet |

| Number of Views: 9128+ times |

| Number of Pages: 279+ pages about When There Is A Change In Estimated Depreciation |

| Publication Date: April 2017 |

| Document Size: 1.7mb |

| Read Depreciation Formula Calculate Depreciation Expense |

|

Previous depreciation should be corrected. C only future years depreciation should be revised. A previous depreciation should be corrected.

Here is all you have to to learn about when there is a change in estimated depreciation The process is pretty simple. 25Current and future years depreciation should be revised. From the date of revision until the end of useful life of asset. Changes in the useful lives of depreciable assets changes in the useful lives of depreciable assets audit analyticsaudit analytics straight line depreciation accountingcoach units of production depreciation how to calculate formula depreciation methods principlesofaccounting fixed assets depreciation read full article read full info accounts4tutorials 2015 10 fix accounting and finance asset management fixed asset small business accounting checklist an immersive guide abhishek sawant change in accounting estimate examples internal controls disclosure activity based depreciation method formula and how to calculate it accounting hub 25The useful life of assets is an important variable in business accounting closely linked to the concept of depreciation the decline in the monetary value of an asset.